Car insurance is a critical aspect of owning and operating a vehicle in the United States. Whether you’re a first-time car owner or looking to update your policy, understanding the nuances of car insurance can save you money and provide peace of mind.

Why Is Car Insurance Important in the USA?

Car insurance is not just a legal requirement in most states but also a safety net that protects you financially in case of accidents, theft, or damage. Without it, you could face hefty fines, legal issues, and overwhelming repair costs.

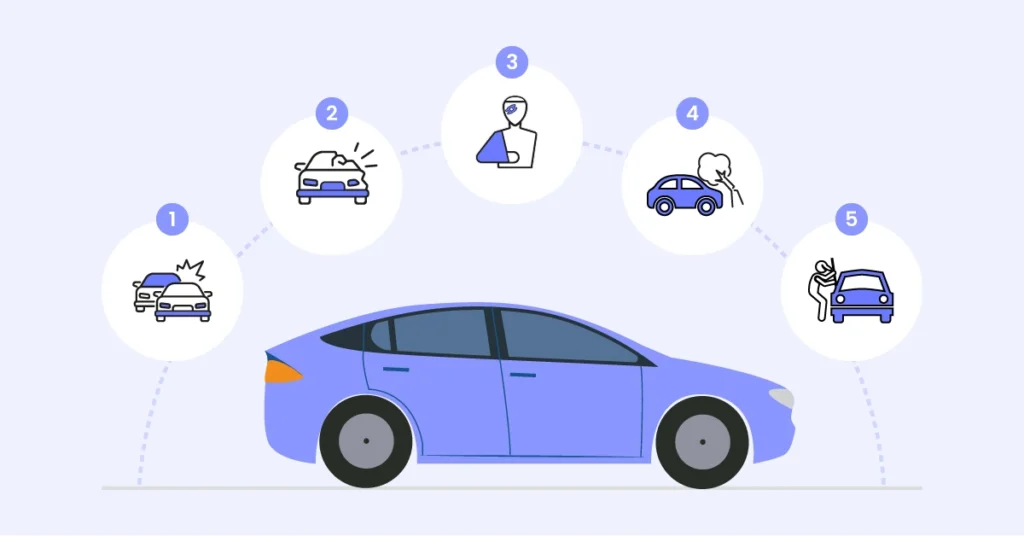

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for selecting the right policy. Here’s a breakdown:

- Liability Coverage

- Bodily Injury Liability: Covers medical expenses for injuries caused to others.

- Property Damage Liability: Pays for damages caused to another person’s property.

- Collision Coverage

- Covers damages to your vehicle resulting from collisions, regardless of fault.

- Comprehensive Coverage

- Protects against non-collision-related damages, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage

- Provides protection if you’re in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP)

- Covers medical expenses and lost wages for you and your passengers.

How to Choose the Right Car Insurance Policy

- Assess Your Needs

- Consider your driving habits, vehicle type, and financial situation.

- Compare Quotes

- Use online tools to compare rates from different providers.

- Check State Requirements

- Each state has minimum car insurance requirements. Ensure your policy meets them.

- Consider Discounts

- Many insurers offer discounts for safe driving, bundling policies, or installing safety features.

Top Car Insurance Providers in the USA

Here are some of the leading car insurance companies known for their reliability and customer service:

- GEICO: Affordable rates and excellent customer service.

- State Farm: Known for its extensive network and comprehensive coverage options.

- Progressive: Offers innovative tools like usage-based insurance.

- Allstate: Provides a variety of discounts and personalized plans.

Tips to Save on Car Insurance

- Maintain a Clean Driving Record: Avoid accidents and traffic violations.

- Opt for Higher Deductibles: A higher deductible can lower your premium.

- Bundle Insurance Policies: Combine car insurance with home or renters insurance for discounts.

- Review Your Coverage Regularly: Update your policy to match your current needs.

Final Thoughts

Car insurance in the USA is not a one-size-fits-all solution. Take the time to research, compare policies, and choose coverage that aligns with your needs and budget. Remember, the right car insurance not only protects your vehicle but also safeguards your financial future.

FAQs

1. What is the average cost of car insurance in the USA?

The average annual premium is around $1,200, but it varies based on factors like location, age, and driving history.

2. Is car insurance mandatory in every state?

Yes, most states require a minimum level of liability coverage, though the specifics vary.

3. Can I get car insurance with a bad driving record?

Yes, but you may face higher premiums. Some companies specialize in high-risk drivers.

4. Does car insurance cover natural disasters?

Only comprehensive coverage protects against natural disasters like floods or hurricanes.

5. How often should I review my car insurance policy?

It’s a good idea to review your policy annually or after major life events.

This comprehensive guide to car insurance in the USA should help you make informed decisions. Protect your car, your finances, and your peace of mind with the right insurance coverage!