Health Insurance: Your Safety Net in an Uncertain World

Let’s be honest—health insurance isn’t the most exciting topic. It doesn’t sparkle like travel plans or thrill like a new gadget. But when life throws a curveball (and it will), health insurance quietly steps in like that dependable friend who always shows up. So, what exactly is health insurance, and why does everyone keep telling you it’s important? Let’s break it down—no jargon, no yawns, just real talk.

What Is Health Insurance, Really?

At its core, health insurance is a financial safety net. You pay a small amount regularly (called a premium), and in return, the insurance company helps cover your medical expenses when you get sick or injured.

Think of it like a shield. You hope you never need it, but when you do, you’ll be glad it’s there. From doctor visits and hospital stays to medicines and surgeries, health insurance keeps your savings from vanishing overnight.

Why Health Insurance Is No Longer Optional

Still wondering if you really need health insurance? Ask yourself this: Can I afford a sudden medical emergency?

Healthcare costs are rising faster than fuel prices. A single hospital visit can drain years of savings. Health insurance:

- Protects you from massive medical bills

- Gives access to better healthcare facilities

- Offers peace of mind (and that’s priceless)

In short, health insurance turns a financial disaster into a manageable inconvenience.

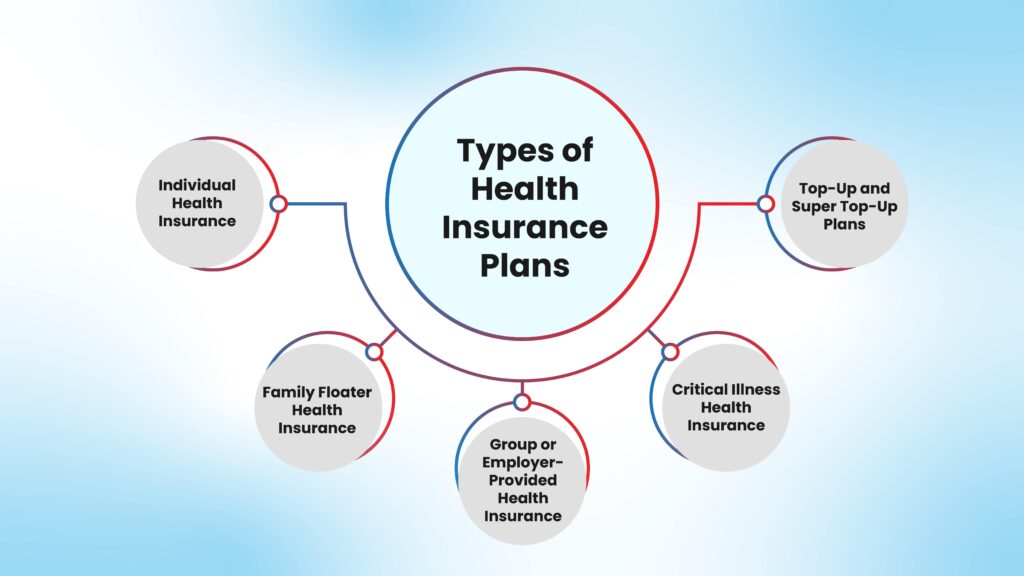

Types of Health Insurance Plans You Should Know

Not all health insurance plans are created equal. Choosing the right one is like picking the right pair of shoes—it has to fit your lifestyle.

Individual Health Insurance

Perfect for singles or freelancers. It covers only one person and offers flexibility in coverage.

Family Floater Plans

One policy covers your entire family. It’s cost-effective and easier to manage—one premium, one policy, everyone covered.

Employer-Provided Health Insurance

Offered by companies as part of employee benefits. Helpful, yes—but often limited. Relying on it alone can be risky.

Senior Citizen Health Insurance

Designed specifically for older adults, covering age-related illnesses and higher medical needs.

What Does Health Insurance Actually Cover?

This is where things get interesting. A good health insurance policy usually covers:

- Hospitalization expenses

- Pre and post-hospitalization costs

- Daycare procedures

- Ambulance charges

- Prescription medicines

- Preventive health check-ups

Some plans even cover mental health treatments and alternative therapies. Sounds good, right? Just remember—coverage varies from policy to policy.

Key Terms You Must Understand (No Skipping!)

Health insurance comes with its own vocabulary. Let’s simplify it:

- Premium: The amount you pay to keep the policy active

- Deductible: The amount you pay before insurance kicks in

- Co-pay: Your share of the medical bill

- Sum Insured: The maximum amount the insurer will pay

Knowing these terms is like knowing the rules of the game—it helps you play smart.

How to Choose the Right Health Insurance Plan

Choosing health insurance isn’t about picking the cheapest option. It’s about picking the right one.

Ask yourself:

- What’s my age and health condition?

- Do I have dependents?

- What hospitals are near me?

- What’s my budget?

Compare plans, read the fine print, and don’t rush. Think of it as investing in your future self—the one who might need care when you least expect it.

Common Myths About Health Insurance (Busted!)

Let’s clear the air.

“I’m young and healthy, I don’t need insurance.”

Wrong. Accidents don’t check your age.

“Health insurance is too expensive.”

One hospital bill can cost more than years of premiums.

“My employer’s insurance is enough.”

Maybe. Maybe not. Job changes happen. Coverage gaps hurt.

The truth? Health insurance is less about fear and more about foresight.

Benefits Beyond Medical Bills

Health insurance isn’t just about emergencies. It also offers:

- Cashless treatment at network hospitals

- Tax benefits under applicable laws

- Access to quality healthcare

- Stress-free recovery

It’s like having a backstage pass to better healthcare—faster, smoother, and less stressful.

When Is the Best Time to Buy Health Insurance?

Short answer? Now.

The earlier you buy, the lower your premium and the wider your coverage. Waiting is like postponing an umbrella purchase until it starts raining—not the smartest move.

Conclusion: Health Insurance Is an Investment, Not an Expense

Health insurance isn’t just a policy—it’s a promise. A promise that you won’t have to choose between your health and your savings. A promise that help is available when life takes an unexpected turn.

So, don’t see health insurance as a boring obligation. See it as your financial bodyguard, standing quietly in the background, ready to step in when needed. Because when it comes to health, playing it safe is the smartest move you can make.